ALUMNI FOCUS

A new era

Enrolling in a higher degree, you anticipate it will have a positive effect on your life. But for Gunjan Pradhan, who had always dreamed of studying in Australia, her MBA (2013) from MQ set off a chain of events that have not just landed her the position of Director Payments at Netflix India and South Asia, she’s now at the forefront of fintech innovation in the region – one of the fastest growing and most exciting fintech markets in the world.

Gunjan Pradhan, speaking via Zoom from the vibrant melting pot of Mumbai in early January, had just returned from a well-earned break. After all, 2022 was a big year for consumer payments at Netflix India as the company had finally transitioned to compliance with new regulations, which meant entities outside those issuing credit and debit cards could no longer store card numbers.

‘It was unprecedented globally,’ says Gunjan, and significant given India’s nascent proficiency in fintech, especially in regard to consumer payments. ‘It meant really looking at the way card payments happen and doing so without customer disruption,’ she says, emphasising the critical consideration of safeguarding the consumer.

In a world where the potential risks for financial fraud are high, it was an ambitious and large-scale project. ‘Previously, entities with a rigorous certification were allowed to store card numbers,’ she explains. ‘This new system was about replacing each card number with a proxy that could not be tied back to the original card number in the free world – it would be meaningless and only make sense if that proxy number operated within that merchant or entity’s system.

‘It was a very complicated project to pull off,’ she admits. ‘As a result, the regulators extended the deadlines several times. The last deadline had been pushed out to 30 September 2022, and there were no more extensions after that – it was ride or die,’ she laughs. ‘It was a huge feat!’

Still, as the last quarter of 2022 progressed, ‘Everything started to work well,’ says Gunjan, who anticipates 2023 will be less hectic as the focus turns to ensuring the systems are performing as expected. Exciting times, nonetheless, as even though the product – called card tokens, which were introduced by VISA and Mastercard six or seven years ago – isn’t mandated globally, Gunjan says there is the possibility that if India gets cited as a success story, it could potentially happen.

‘The work at Netflix is so fantastic,’ enthuses Gunjan. ‘India is an incredible hub for growth – everything interesting or exciting in the world seems to be happening here. It’s very dynamic, largely because we have one of the world’s youngest populations.

‘All sorts of brands are vying for business in India. Growth, affordability and willingness to pay are at an all-time high because of the younger generation – they’re more open to experimenting, they’re open to international brands, and they’re open to brands that have a good concept.

‘And, as a country with such a large population,’ she adds, ‘it’s also a great test bed for your hypotheses. In terms of fintech, and payments in particular, India feels like where the action is – we’re barely scratching the surface in terms of innovation.’

Being on the cusp of innovation in a booming fintech industry wasn’t always on the radar for Gunjan, however, who had trained as an engineer and was working in the oil and gas industry in India. That is, until she decided to undertake an MBA at the Macquarie Graduate School of Management, as it was known at the time. (Now Macquarie Business School.)

‘I found my love for payments and fintech at Macquarie,’ shares Gunjan, who says, ‘my MBA studies gave me the essential toolkit and launching pad to make a career shift. I was surprised that the subjects I enjoyed were the financial management ones, and economics and accounting. I was absolutely fascinated by them and gained a deep appreciation of the numerous economies, cultures, customer behaviours and businesses around the world – until then, I was only aware of the world through the lens of my India experience.’

Initially drawn to MGSM due to its ranking in the top 50 global business schools, Gunjan explains that the clear three- to five-year work experience requirement for the MBA program was appealing too. ‘It gave me the opportunity to learn not just from the curriculum but also from colleagues’ varied work experiences,’ she says. ‘It taught me to be curious and demand that back from others; it introduced me to a diversity of mindset.’

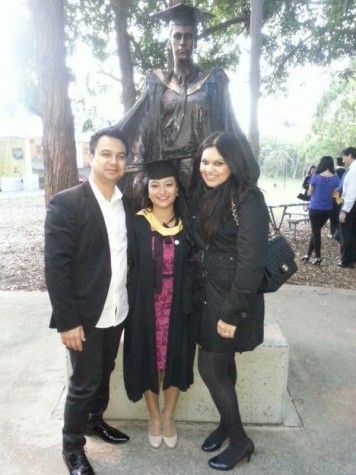

Indeed, the MQ community has had a lasting impact too. ‘The friendships I forged at MGSM with people from across the globe have been invaluable, and being part of the alumni and keeping in touch with the institution that nurtured us provides a great sense of belonging.’

Gunjan and her husband are both active members of the alumni in India, and were involved in building the MQ Alumni India Chapter with the MQ Alumni team. ‘We’ve also partnered with the team on various initiatives like connecting with the alumni community and networking with Global Alumni Leaders,’ she explains. ‘We attend events and speak at recruitment drives and to prospective students.’

And, as no small aside, it was through the alumni that the pair first met. Gunjan explains, ‘When I shared with a dear friend, who used to manage MGSM Alumni Relations, that I was going back to India, she offered to introduce me personally to her contacts – my husband happened to be one of them. We stayed in touch and were married at the end of 2014.’

And, if more proof was needed of her fondness for MQ and the city she called home while doing her MBA, Gunjan and her husband named their daughter Sydney. ‘MGSM and Sydney have had an incredible influence on my life,’ she shares. ‘I’m very attached to Australia and love Sydney in particular; it has such a beautiful spirit. There are people from all walks of life, all nationalities, and the weather is perfect.’

But is it enough to lure her back? ‘Not yet,’ she admits. ‘There’s just too much going on in India. Consumer payments globally is undergoing incredible innovation, and it’s exciting to be at the centre of it all.’

Of course, especially in light of the enormous project she has just completed, she admits, ‘shaping and influencing consumer payments in these markets is very challenging, but it’s also very rewarding. I’m in the right place to be able to make a difference in ushering in an entirely new era of fintech innovation.’

Macquarie University’s official Alumni Network – India on LinkedIn connects you with alumni right across India. Make new connections, participate in discussions, and even start some of your own!

Gunjan Pradhan graduated from Macquarie University’s MBA program in 2012, receiving three Certificate of Merit awards for the highest mark scored in the MBA class.

Currently working as the Director of Payments India for Netflix, the world’s leading streaming entertainment service, she has been responsible for consumer payments in India, South Asia, Australia and New Zealand. Gunjan has previously worked on payments with start-ups such as Citrus and PayU India.

In 2019, she was selected as a Women in Payments Rise Up Power Player, one of the Top 30 in Asia.